If you are the person responsible for estate administration after a loved one has died, we know it can be an emotionally fraught and overwhelming time. We are here to help guide you through the probate process and share the key things you need to know before you begin.

What is probate?

Probate is having a legal right to deal with someone’s estate (everything they own) when they die.

You need to apply for a Grant of Probate to legally allow you to deal with your loved one’s finances and sell their property.

When is probate required?

If the person who has died owned property or significant assets in their sole name then probate will be required.

Probate will also be needed if a financial institution, such as a bank, has requested a Grant of Probate or Letters of Administration, otherwise they can refuse to release the Deceased’s funds.

If you are not sure whether probate is necessary, we advise contacting the financial institutions that hold the Deceased person’s assets.

When is probate not required?

There are a few situations when probate may not be required:

- The Deceased person owned property and financial assets in joint names – In these cases, property and assets will pass to the joint owner under the law of ‘survivorship’, regardless of what the Deceased person wrote in their Will.

- The Deceased’s debts are greater than their assets, so their estate is insolvent – It may not be necessary in these circumstances to apply for a grant of probate, however, it is very important to seek legal advice.

- The Deceased’s assets are held in a trust – The person may have put assets into a trust as part of tax planning which means the Trustees own the assets. Similarly, if the person was the beneficiary of a trust during their lifetime, these assets are legally owned by the Trustees.

- For pension payments – Distribution of money is normally managed by the pension company, so probate would not normally be required to deal with this asset.

How do you start the probate process?

To have the legal authority to administer a Deceased person’s estate, the Executor of a Will needs to apply to the Probate Registry for a Grant of Representation. If there is no Will then the Estate Administrator needs to apply instead (see ‘What if there’s no Will?’ section below).

A Grant of Representation gives an Executor or Estate Administrator the right to undertake financial tasks such as closing bank accounts, distributing assets, and selling property and other assets.

There are two types of Grant of Representation: Grant of Probate (when there is a valid Will) and Letters of Administration (when there is not).

What is a Grant of Probate?

A Grant of Probate is where the Executor/s named in a Will have obtained a Grant of Representation by the courts. It confirms that the Executor/s have the legal authority to administer the Deceased person’s property and assets.

An Executor must prove a valid Will to the Probate courts and will need to sign a Statement of Truth which verifies the application.

A Grant of Probate is a legal document that offers security to anyone who distributes assets to or purchases assets from an Executor. If, for example, an Executor sold a Deceased’s property without a Grant of Probate and the Will was found to be invalid, the purchaser could lose the property because the Executor had no right to sell it to them.

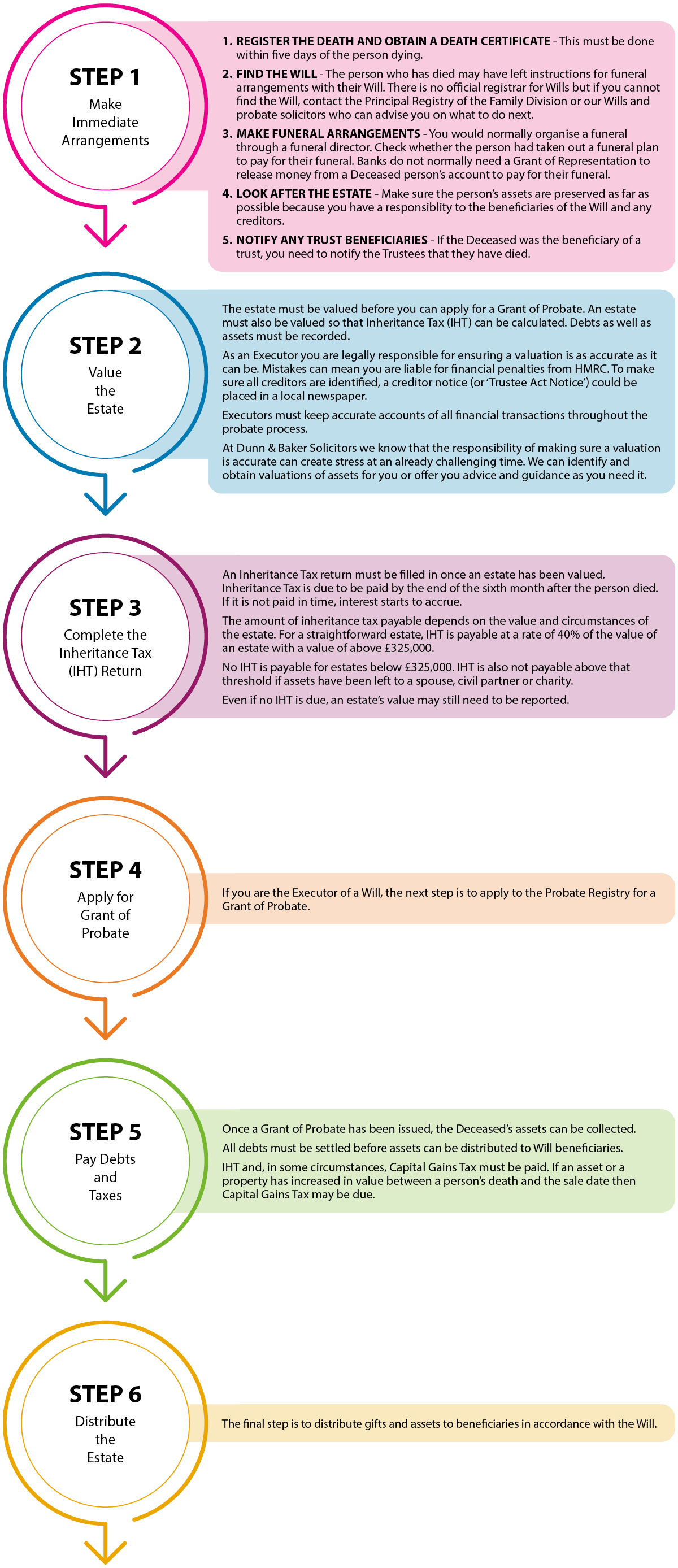

What is the probate process?

Usually, only an Executor named in a Will can apply for a probate.

What is a personal representative?

A personal representative is the Executor of a Will who is responsible for the estate administration.

Where there is no Will, the personal representative is the estate Administrator.

What if there’s no Will?

When someone has died without a Will or has failed to dispose of their estate by Will, a person is said to have died ‘intestate.’ When someone dies intestate, their personal representative can be a family member. However, the law on intestacy means that only certain people can inherit the Deceased’s estate.

People who are most likely to inherit under an intestacy are the Deceased’s spouse or civil partner, where they have one, but they can only inherit if they were legally married or in a civil partnership before the death of the Deceased. Divorce or legally ending a civil partnership means you are no longer entitled to the Deceased’s estate.

If you were separated informally from the Deceased, there is still a potential you can inherit, however, cohabiting partners cannot inherit. It is therefore most important that cohabiting partners should consider making Wills to potentially give an element of security to the other.

If the Deceased had surviving children or even grandchildren (when there are no surviving children) at the date of death, they will also be entitled to part of the estate. The distribution of the Deceased estate is as follows:

The Deceased wife/husband or civil partner will inherit:

- Personal possessions

- The first £270,000 of the estate

- Half of the remaining estate, after the first £270,000 has been allocated to them

- Certain types of jointly owned property/ other assets. We would recommend taking legal advice regarding any property/ other assets that the Deceased owned jointly.

- The other half of the remaining estate will pass equally between the children.

If there was no marriage or civil partnership, the Deceased’s children inherit all of the estate in equal shares. If there are no children, spouse or civil partner, there is a possibility for siblings to inherit.

A personal representative needs to apply to the Probate Registry for Letters of Administration. Just like a Grant of Probate, this document gives legal permission to manage and distribute an estate, including closing bank accounts, and selling property and shares.

The probate process is often quicker and more straightforward when there is a Will. A Will also ensures the right people inherit and they receive the maximum financial benefit in accordance with the Deceased’s wishes. Planning assets ahead of time can also reduce IHT.

Do you need probate for a small estate?

Probate is not usually needed for small estates.

However, each bank and financial institution has their own definition of a small estate.

Estates valued at under £5,000 are considered small but the figure can be up to £50,000.

How long does probate take?

Probate proceedings can often take 1 to 2 years on average. With straightforward estates it can be a few months less than this. When there is no Will or there is difficulty valuing an estate, the process can take longer than a year.

Are probate fees payable?

Probate court fees depend on the value of an estate. The probate application fee for an estate valued over £5,000 is £273.

How Dunn & Baker Solicitors can help:

If you are a personal representative, our specialist probate solicitors can guide you through every step of estate administration. Whether there is a Will or not, we make sure the process is as fast and straightforward as possible.

Our solicitors understand that managing a loved one’s estate is complex at an emotionally difficult time. We are here to relieve some of the stress by providing you with as much, or as little, help as you need.

We can work alongside you, offering advice when you need it or we can act as a professional Executor by managing the entire process from start to finish.

To discuss how we can help, please contact us today so that we can answer all of your questions from ‘what is probate?’ to ‘I cannot find a Will – what should I do?’

Exeter 01392 285000 Cullompton 01884 33818