Why should you write a Will?

Writing a will allows you to have control over your money, property, possessions and investments after you die, and is the only way to ensure that your estate goes to the people and causes you care about. Without a will, Rules of Intestacy determine how your assets are distributed.

It’s reported that only about 44% of adults have made a will, with 42% never having discussed with their family what should happen to their estate after their death. Even among those over 55, three in ten have never spoken to someone about their legacy, for fear of a morbid conversation or not being particularly concerned about what happens to their estate.

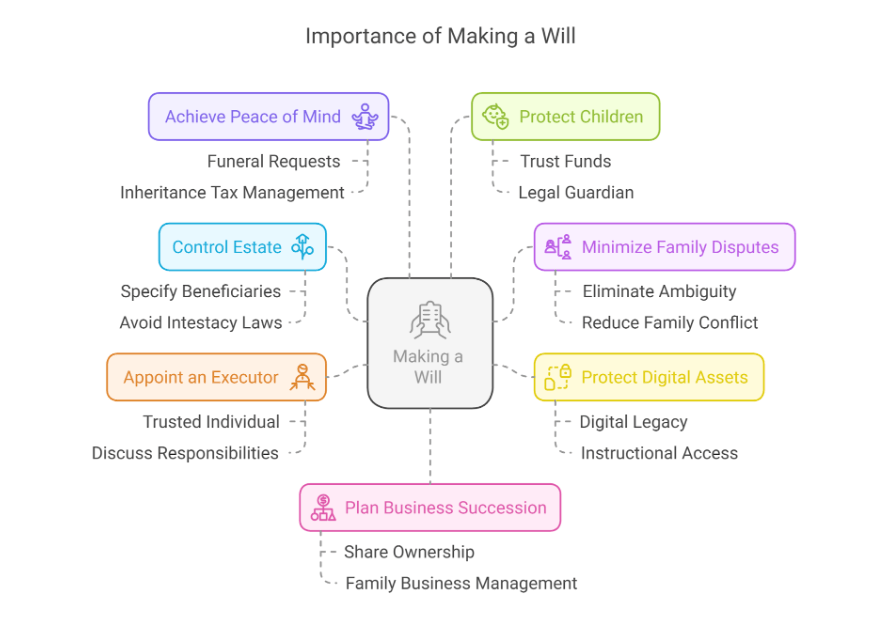

Read on to discover why making a will is so important and why it’s the greatest gift you can leave your loved ones. Some of the reasons to make a will are as follows:

Control your estate

Making a will allows you to control your estate by specifying who inherits your assets after you die.

Appointing beneficiaries gives you the power to distribute money and property as you intended, rather than having your estate managed according to legal defaults: if you die without a will, intestacy laws dictate who inherits what. If there are no surviving relatives, the crown gain control of your estate.

Minimise the risk of family disputes

With a professionally drafted and well documented will, your estate can be shared according to your wishes. Your beneficiaries will see where you want your money, property and possessions to go, taking the guess work out of who gets what.

A well written will eliminates ambiguity around your wishes, mitigating the risk of family arguments after your death. Although it’s possible for someone to contest a will, it’s rarely done successfully if a will is clear and precise.

Protect your digital assets

Many treasured possessions are now accessed remotely, from personal photographs to password-protected documents. Banking, pensions and investments are often done online now, so it’s important that your loved ones can access these platforms after you die.

You can protect your digital legacy by drafting a comprehensive and instructional will for your appointed representative, detailing what can be accessed online, and how.

Appoint an executor

Appointing an executor of the will allows you to place a trusted person in charge of settling your affairs and distributing assets according to your wishes.

The choice of executor is an important one: it should be someone who is capable, trustworthy and available to take on the task. It’s advisable to discuss with a potential executor what’s expected of them before finalising the will.

Achieve peace of mind

Drafting a will can eliminate stress for you and your loved ones by clearly outlining your intentions.

You can specify any funeral requests, safeguard your family home, determine who receives what, donate to organisations or charities and help manage your inheritance tax, but most importantly, you can rest assured that your loved ones will be taken care of after you die.

You can also minimise stress for your next of kin by writing a will and planning ahead for peace of mind, which will lessen the bureaucracy and arrangements required of them after you die.

Protect your children

With a will, you can make plans to provide for your children’s financial future. Setting up a trust fund, for example, allows you to control when your child receives the money and for what it can be used.

If you have children under 18, you can appoint a legal guardian in your will, entrusting the care of your children to someone you believe can raise them best. If you die without a will, it’s a judge who makes this crucial decision.

Plan your business succession

Your written will can explicitly state who will inherit your business shares or ownership, potentially with stipulations included, such as who can own the shares in future and who can work for the business, ensuring your wishes are protected.

The lack of a will could mean your business or shareholding being inherited by someone who has no interest in its success or who doesn’t have the necessary skills to run it successfully, or could cause conflict between multiple people on how it should be run.

Making a will allows for appointing someone who you think is best placed to manage your business, and if applicable, your business can be kept within the family.

Whether you should use a solicitor

A will is one of the most important documents you can have in place, ensuring your relatives are looked after and your wishes respected after you die. Although it’s possible to draft a will yourself, it’s imperative that it’s clear and precise and that your relatives are aware of where it’s kept.

It’s advisable to find a solicitor when making a will, as their expertise means they can advise you on what should be included and can ensure that it contains no ambiguity in meaning, mitigating the risk of confusion and disputes down the line.

Such an important task requires expert assistance, leaving you safe in the knowledge that you’ve done all you can to protect your loved ones’ future. For more details follow our will guide.